Planning a wedding insurance is an exciting yet complex process. With months of preparation, significant financial investment, and high emotional stakes, ensuring that your special day goes smoothly is a top priority. However, unexpected events can disrupt even the best-laid plans. This is where wedding insurance comes into play. Wedding insurance provides financial protection against unforeseen circumstances that could impact your wedding. In this article, we will explore what wedding insurance covers and why it is essential.

What Is Wedding Insurance?

Wedding insurance is a specialized type of event insurance that protects couples against financial losses related to their wedding. It provides coverage for various risks, including vendor cancellations, property damage, severe weather, and even illness or injury. Wedding insurance typically falls into two categories: liability insurance and cancellation/postponement insurance.

Liability Insurance: This covers accidents and damages that may occur during the wedding. For example, if a guest is injured at your venue or if property damage occurs, liability insurance can help cover medical expenses or repair costs.

Cancellation/Postponement Insurance: If unforeseen circumstances force you to cancel or postpone your wedding, this insurance can help reimburse lost deposits and additional expenses.

What Does Wedding Insurance Cover?

Wedding insurance policies vary by provider, but they generally cover the following:

1. Venue Issues

Your chosen wedding venue is crucial to your big day. However, what happens if the venue unexpectedly shuts down or becomes unavailable due to unforeseen circumstances? Wedding insurance can help cover the costs of finding and securing an alternative venue.

2. Vendor Cancellations

From caterers to photographers, weddings rely on multiple vendors. If a vendor fails to deliver due to bankruptcy, illness, or other issues, wedding insurance can cover lost deposits and additional costs required to secure a replacement.

3. Severe Weather

Extreme weather conditions such as hurricanes, floods, or snowstorms can prevent the wedding from taking place. Wedding insurance ensures that if a natural disaster disrupts your wedding, you can recover costs and reschedule the event.

4. Illness or Injury

If the bride, groom, or an essential family member becomes seriously ill or injured, wedding insurance can help cover the costs of postponement.

5. Lost or Damaged Attire

Wedding attire is a significant investment. If your wedding dress, tuxedo, or other essential clothing is lost, stolen, or damaged before the wedding, insurance can cover replacement or repair costs.

6. Property Damage and Accidents

If someone accidentally damages the venue or if a guest suffers an injury during the wedding, liability insurance can cover medical bills and repair costs.

7. Military or Work Obligations

If the bride or groom is in the military or has an unavoidable work-related commitment that forces the wedding to be postponed, wedding insurance can help cover rescheduling expenses.

Why Wedding Insurance Matters

1. Protects Your Financial Investment

Weddings can be expensive, with costs ranging from thousands to tens of thousands of dollars. Wedding insurance ensures that you do not suffer a significant financial loss if something goes wrong.

2. Reduces Stress and Anxiety

Knowing that you have a safety net in place allows you to plan your wedding with greater peace of mind. If an issue arises, you can focus on solutions without worrying about financial repercussions.

3. Covers Unexpected Situations

No matter how meticulously you plan, some things are beyond your control. From bad weather to vendor bankruptcies, wedding insurance protects against these uncertainties.

4. Required by Some Venues

Many venues require couples to have liability insurance before hosting an event. Having wedding insurance ensures compliance with venue policies while providing additional protection.

5. Peace of Mind for You and Your Guests

Weddings are about celebrating love with family and friends. Knowing that potential risks are covered allows you and your guests to enjoy the day without worry.

How to Choose the Right Wedding Insurance

When selecting a wedding insurance policy, consider the following factors:

Coverage Options: Ensure the policy covers essential aspects such as venue issues, vendor cancellations, liability, and severe weather.

Policy Limits: Check how much coverage is provided for each category.

Exclusions: Understand what is not covered, such as pre-existing conditions, change of heart, or intentionally caused damages.

Cost: Compare policies from different providers to find the best coverage within your budget.

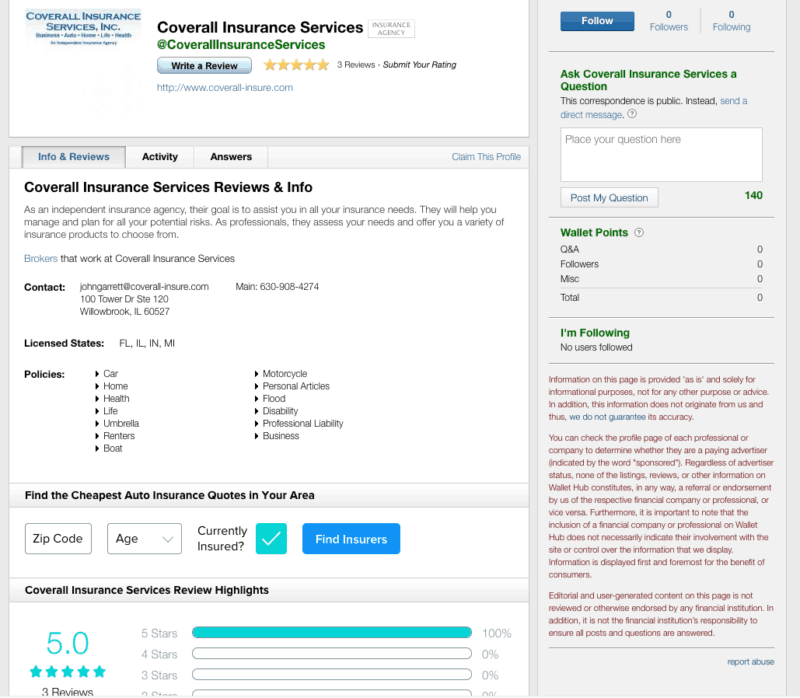

Reputation of the Provider: Choose a reputable insurance company with good customer reviews and reliable claim processes.

Conclusion

Wedding insurance is a smart investment for couples who want to protect their special day from unforeseen circumstances. From vendor failures to unexpected weather disruptions, wedding insurance provides financial security and peace of mind. By carefully selecting a policy that meets your needs, you can ensure that your wedding day remains a joyous and stress-free occasion. While no one anticipates problems, being prepared is always the best approach. With wedding insurance, you can focus on what truly matters—celebrating love and creating lasting memories.