Understanding the Importance of Insurance Plans

The Role of Insurance

Insurance plan is a vital tool in protecting yourself and your loved ones against unforeseen events. Whether it’s health, property, or life insurance, having the right plan ensures that you have financial security in times of need.

Identifying Your Needs

Before diving into the world of insurance plan, it’s crucial to understand your specific needs. Assess your current situation, your assets, and your dependents to determine the type of coverage required.

What to Look for in an Insurance Plan

Cost of Premiums

The first factor to consider when choosing an insurance plan is the cost. Evaluate your budget and determine what premium you can comfortably afford on a regular basis. Keep in mind that higher premiums often come with more extensive coverage.

Types of Coverage

Each insurance plan provides varying types of coverage. Identify the areas where you need protection and ensure that the plan you choose adequately addresses your specific needs.

Network and Providers

Consider the network and providers associated with the insurance plan. Ensure that your preferred doctors, hospitals, and specialists are included in the network to receive the care you need.

Deductibles and Out-of-Pocket Costs

Understanding deductibles and out-of-pocket costs is essential to assess the affordability of an insurance plan. Determine how much you would be responsible for paying before the insurance coverage kicks in.

The Different Types of Insurance Plans Available

Health Insurance

Health insurance plans offer coverage for medical expenses, including doctor visits, hospital stays, and prescription medications. They come in various forms, such as Health Maintenance Organization (HMO), Preferred Provider Organization (PPO), and Point of Service (POS) plans.

Property Insurance

Property insurance covers damages to your home, belongings, or other properties. It provides financial protection against events like natural disasters, theft, or fire.

Life Insurance

Life insurance offers financial protection to your loved ones in the event of your death. It helps cover funeral expenses, mortgage payments, and income replacement.

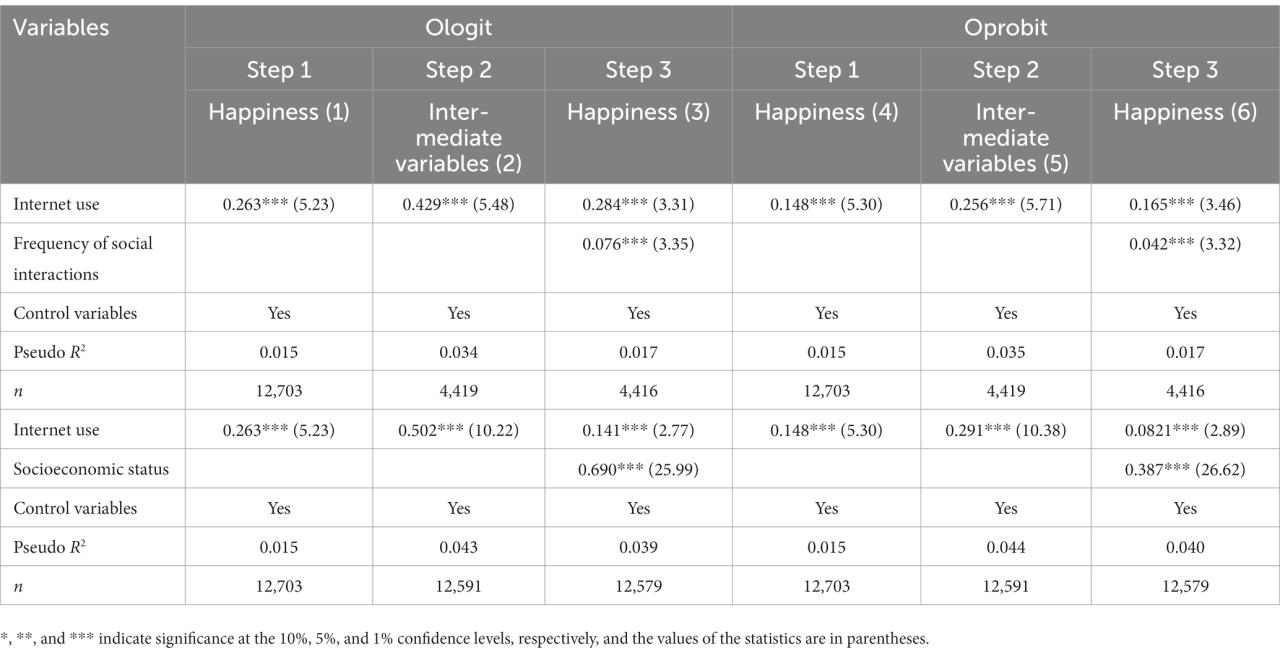

Factors to Consider when Comparing Insurance Plans

Policy Limits

Check the policy limits of different insurance plans to ensure they meet your needs. Policy limits determine the maximum amount an insurance company will pay for a covered loss.

Exclusions

Exclusions are specific situations or events that an insurance plan does not cover. Carefully read through the policy exclusions to understand what circumstances will not be eligible for compensation.

Customer Reviews

One way to assess the quality of an insurance plan is by reading customer reviews. Reviews provide insights into the experiences of policyholders and can help you make an informed decision.

Financial Strength

Consider the financial strength and stability of the insurance company. You want to ensure that they have the ability to pay claims promptly and have a solid reputation within the industry.

Table: Comparison of Insurance Plan Options

| Insurance Plan | Premium | Coverage | Policy Limits |

|---|---|---|---|

| Plan A | $100/month | Health, Property, Life | $500,000 |

| Plan B | $150/month | Health, Property | $1,000,000 |

| Plan C | $80/month | Life | $300,000 |

Conclusion

Choosing the right insurance plan requires careful consideration of your needs, budget, and the coverage provided. By understanding the various factors and types of insurance plans available, you can make an informed decision that provides you with the protection you need. Remember to always review the terms and conditions of each plan and consult an insurance professional if you have any doubts.

To learn more about insurance options and how to make the best choice for your needs, read our article on “Understanding the Importance of Insurance” from the list of articles below.