The insurance industry is on the cusp of a major transformation. Driven by technological advancements, changing consumer expectations, and a rapidly evolving risk landscape, the future of insurance in 2025 promises to be drastically different from what we see today. This article explores the key trends and innovations shaping The Future of Insurance: Trends and Innovations in 2025, offering a glimpse into the exciting possibilities that lie ahead.

The Rise of Personalized Insurance

Data-Driven Customization

Imagine insurance policies tailored specifically to your individual needs and behaviors. Innovations In 2025, this will become increasingly common. Thanks to the explosion of data from connected devices, wearables, and online activity, insurers can now gain a much deeper understanding of individual risk profiles. This allows them to offer personalized premiums, customized coverage options, and even proactive risk mitigation advice.

This shift towards personalization goes beyond simply adjusting premiums based on driving habits. We’re talking about policies that consider your health data, lifestyle choices, and even your profession to create a truly bespoke insurance experience.

On-Demand and Micro-Insurance

Gone are the days of rigid annual contracts. The future of insurance Innovations in 2025 will see a rise in on-demand and micro-insurance products. Need coverage for just a few hours? Want to insure a single valuable item for a short period? These options will become readily available, offering flexibility and affordability for consumers.

This trend is particularly relevant to the gig economy and the sharing economy, where traditional insurance models often fall short. Imagine insuring your drone for a specific delivery, or your car only for the hours you’re using it for ride-sharing.

Gamification and Incentives

Insurers are increasingly using gamification and incentive programs to encourage safer behavior. Think of apps that reward safe driving with discounts on premiums, or wearable devices that track healthy habits and offer premium reductions for maintaining a healthy lifestyle.

This approach not only benefits consumers but also helps insurers mitigate risk, creating a win-win scenario.

Embracing Artificial Intelligence and Automation

AI-Powered Claims Processing

Say goodbye to lengthy claims processes. In 2025, artificial intelligence will play a crucial role in automating and streamlining claims. AI algorithms can analyze claims data, assess damage, and even automatically approve payouts, significantly reducing processing times and improving customer satisfaction.

This automation frees up human agents to focus on more complex claims and provide personalized support, enhancing the overall customer experience.

Predictive Analytics and Risk Management

AI isn’t just about processing claims faster. It’s also about predicting and preventing them in the first place. By analyzing vast datasets, AI algorithms can identify potential risks and help insurers develop proactive risk management strategies.

This could involve anything from predicting weather-related damage to identifying high-risk individuals and offering personalized safety recommendations.

Chatbots and Virtual Assistants

Need help with your policy? In 2025, you’ll likely be interacting with a chatbot or virtual assistant. These AI-powered tools can answer common questions, provide policy information, and even guide you through the claims process, offering 24/7 support and improved accessibility.

This shift towards automated customer service will not only improve efficiency but also reduce costs for insurers.

The Evolution of Insurance Products

Cyber Insurance in a Connected World

As our lives become increasingly digital, the need for cyber insurance will only grow. In 2025, cyber insurance will evolve to cover a wider range of risks, from data breaches and ransomware attacks to identity theft and online harassment.

This will be crucial for both individuals and businesses, providing protection against the ever-evolving threats in the digital landscape.

Climate Change and Parametric Insurance

The increasing frequency and severity of extreme weather events are driving demand for innovative insurance solutions. Parametric insurance, which triggers payouts based on pre-defined parameters (such as wind speed or rainfall), is gaining traction. In 2025, we can expect to see more sophisticated parametric insurance products designed to address the specific risks posed by climate change.

This type of insurance offers a faster and more transparent claims process, particularly beneficial in the aftermath of natural disasters.

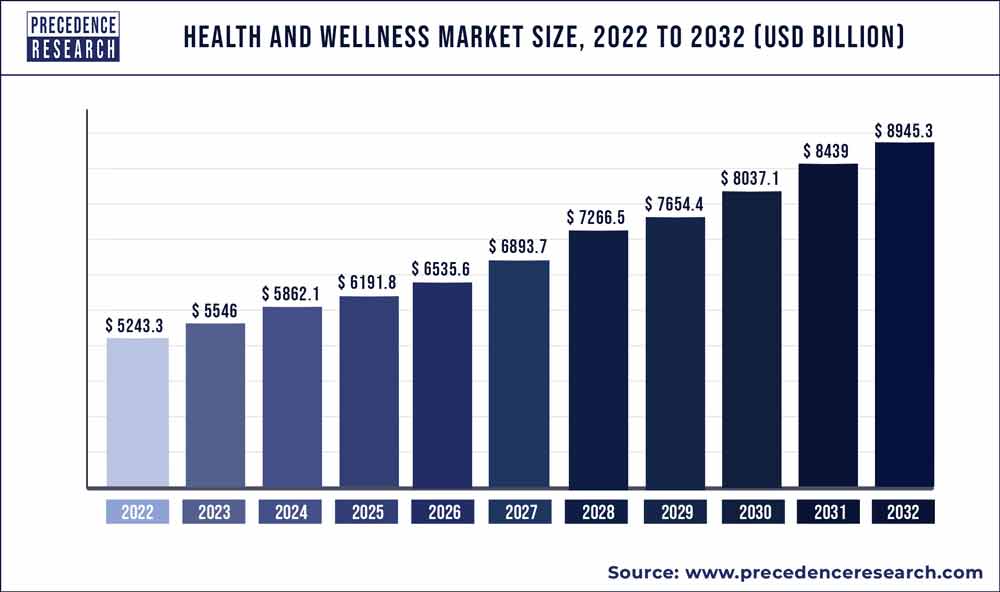

The Future of Insurance: Trends and Innovations in 2025: Health and Wellness Integration

The lines between insurance and healthcare are blurring. In 2025, we’ll see greater integration between health and wellness programs and insurance offerings. This could involve personalized health recommendations, incentivized wellness programs, and even telemedicine services integrated into insurance plans.

This holistic approach to health and wellness will not only improve outcomes for individuals but also help insurers manage healthcare costs more effectively. The future of insurance in 2025 is all about personalization, prevention, and proactive risk management.

Table: Key Trends and Innovations in Insurance 2025

| Trend/Innovation | Description | Impact |

|---|---|---|

| Personalized Insurance | Tailored policies based on individual risk profiles | More accurate pricing, customized coverage |

| On-Demand Insurance | Flexible, short-term coverage | Increased accessibility and affordability |

| AI-Powered Claims Processing | Automated claims handling | Faster payouts, improved customer satisfaction |

| Predictive Analytics | Identifying potential risks and preventing claims | Proactive risk management, reduced losses |

| Cyber Insurance | Protection against digital threats | Enhanced security in a connected world |

| Parametric Insurance | Triggered payouts based on pre-defined parameters | Faster claims processing for natural disasters |

| Health & Wellness Integration | Combining insurance with health programs | Improved health outcomes, cost management |

Conclusion

The future of insurance in 2025 is bright, filled with exciting possibilities. From personalized policies and AI-powered claims processing to innovative products addressing emerging risks, the industry is undergoing a dramatic transformation. We hope this overview of The Future of Insurance: Trends and Innovations in 2025 has provided valuable insights. Be sure to check out our other articles on [link to other articles] for more in-depth analysis of specific trends and innovations.

FAQ about The Future of Insurance: Trends and Innovations in 2025

1. What is the biggest trend expected in insurance by 2025?

Increased personalization. Insurance will be tailored more than ever to individual needs and behaviors, using data to create custom policies.

2. How will AI impact insurance in the near future?

AI will automate tasks like claims processing and fraud detection, making things faster and cheaper for both insurers and customers. It will also help personalize premiums.

3. What is embedded insurance?

Embedded insurance seamlessly integrates insurance into other products and services. Think buying car insurance directly from the car dealership’s website when you purchase a vehicle.

4. Will insurance become more preventative?

Yes, wearable technology and telematics will allow insurers to monitor health and driving habits, potentially offering discounts for healthy lifestyles and safe driving. This could also lead to personalized preventative advice.

5. How will blockchain affect the insurance industry?

Blockchain can improve transparency and security in insurance, particularly with complex claims processing and fraud prevention.

6. What is on-demand insurance?

On-demand insurance allows you to activate coverage only when you need it, like insuring a drone only for the time you are flying it. This provides flexibility and potentially lower costs.

7. Will insurance still be affordable in the future?

Increased competition and automation driven by these innovations could help keep insurance affordable, despite rising risks.

8. How will climate change affect insurance?

Climate change will likely lead to more frequent and severe weather events, impacting insurance premiums and prompting new types of coverage for climate-related risks.

9. What role will the Internet of Things (IoT) play in insurance?

Connected devices like smart home sensors can help prevent accidents and losses, leading to lower premiums and better risk management.

10. What can I do to prepare for the future of insurance?

Stay informed about these trends, be open to new technologies, and compare policies to find the best fit for your changing needs.